Military retirement calculator high 3

Subtract 3 years 0 months and 0 days from the retirement date year-month-day in 2 in order to determine the beginning day of the three-year period. Reserve or national guard members under Title 32 can collect both a federal civil service retirement and a reserve or national guard retirement.

Military Retirement And Transition Services

Under the former rule in Colorado the marital share of the retirement would be 5 years of marriage.

. E-9 with 28 years of service and a High-3 pay of 6800 at retirement. This retirement plan offers a pension after 20 years of service that equals 25 of your average basic pay for your three highest-paid years or 36 months for each year you serve. Your high-3 does not have to be 3 calendar years ie January-December.

I could forsee a situation where an extreme early retiree could end up with a negative net income tax burden on a lifetime basis. The beginning date of Jerrys three-year. This three-year period can be at any point in your career.

Jones High-3 COLA is the full CPI 35 each year for our example so Jones gets a 35 raise. Military Service before 12311956. In order to determine the best and worst states for military retirement WalletHub compared the 50 states and the District of Columbia across three key dimensions.

Changes in median income reflect several trends. The Current Population Survey of the US. For example a 20 year retirement is worth 50 of your base pay 20 years times 25 500.

Your employer contributes to your pension and you contribute to the investment account. Every calculator link I can find isnt working. Agree that RRSPs are a fantastic tool for early retirees.

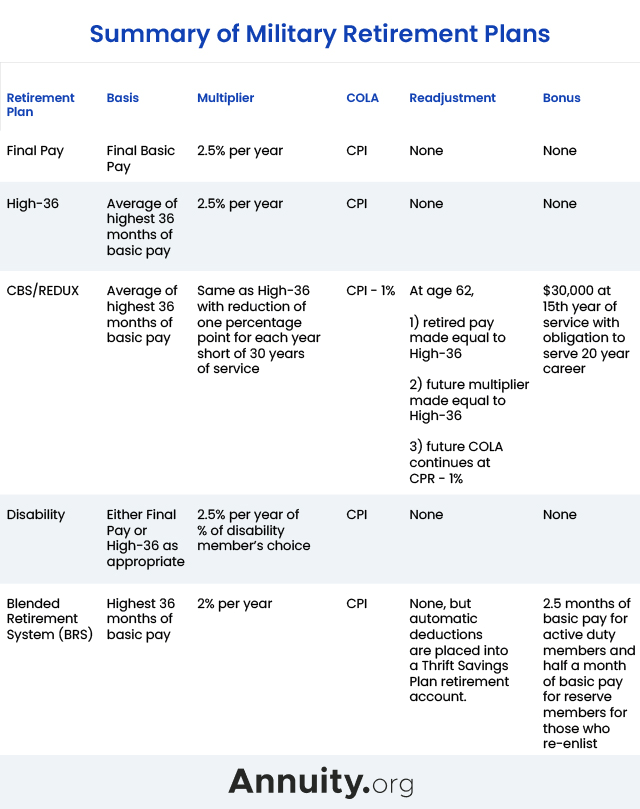

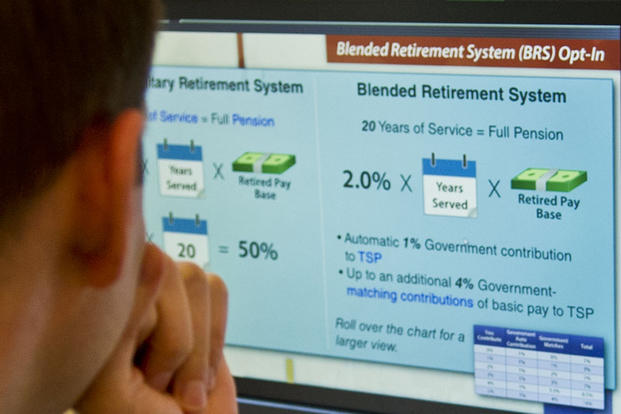

This calculator is designed to assist eligible service members in comparing the legacy military retirement system commonly referred to as the Hi-3 System and the Blended Retirement System BRS. Of course there will be outliers based on when you served your career field and other factors but these ranks and service times should apply to the majority of careers if anything I am aiming on the conservative side because many people choose to serve longer than the 20 year mark earning an extra 25-35 on their retirement pay per. Also called High-36 or military retired pay this is a defined benefit plan.

Death Gratuity New Retired Benefits Program. By law members may receive credit for up to 60 inactive points for retirement years that ended before Sep. To begin using the Military Pay Calculator first choose your status.

23 1996 up to 75 inactive points for retirement years ending on or after Sep. How to use the High-3 military retirement calculator. Military Retirement Calculator - Compare military retirement pay against different retirement dates and ranks estimate future pay for 40 years after retirement and automatically calculates early retirement pay if you enter a retirement date that is less than 20 years of service.

For example if you had the highest average basic pay between May 2013 and May 2016 then that is the 3 years years that will be used. Retirement Eligibility and Military Credits. An Active Duty retirement is worth 25 of your base pay for each year you served for the High Pay and High-3 retirement plans.

By retiring pre-65 and keeping withdrawls low you essentially game the system. When you meet plan requirements and retire you are guaranteed a monthly benefit for the rest of your life from the employer-funded pension. Public Employees Retirement System PERS Plan 3.

The following two examples will illustrate. High 3 allocates retirement pay equal to 50 percent of average basic pay over the three highest income years for those having served 20 years of military service The High 36 Retirement Program. Service members in the legacy High-3 system must have begun their service by December 31 2017.

1 Economic Environment 2 Quality of Life and 3 Health Care. Especially if you are high income pre-retirement. Just need to talk to.

Whether Active Duty National Guard or Reserve. Your High-3 is the average of your highest-paid period for 36 consecutive months. The FERs calculator requires an annual 12 month salary for this calculation.

Legacy High-3 High-36 System. This calculator is for regular FERS only and does not. Calculate your pension under the BRS.

The legacy retirement annuity is based on 2 ½ per year served. It is intended to be used in conjunction with the mandatory BRS Opt-In Course. 8 1980 and July 31 1986 you can use the High-3 Calculator to figure out your estimated base pay.

Your high-3 will automatically be the 3 years that you had the highest pay regardless of when it occured in your career. This means that if you retire at 20 years your retirement will be 40 of your base pay - 30 years minus 20 years 10 years the normal High 36 retirement pay at 20 years is 50 of your base pay. Census Bureau reported in September 2017 that real median household income was 59039 in 2016 exceeding any previous year.

Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. Redux pays 40 percent for a member with 20 years of military service. If you joined between Sept.

This cross-over would happen earlier if after tax earnings from the mutual fundsavings were much less than 8 percent and would happen later if higher than 8 percent. Then scroll down to find your current pay grade. Lastly the FERS calculator requires an estimate of your High-3.

This was the fourth consecutive year with a statistically significant increase by their measure. BRS Comparison Calculator BRS Calculator High-3 Calculator Final-Pay Calculator REDUX Calculator RMC Calculator SCAADL Calculator Benefits. We evaluated those dimensions using 29 relevant metrics which are listed below with their corresponding weights.

Assuming a 25 annual multiplier the members retirement would be 28 x 0025 x 6800 or 4760. E1-9 W1-5 or O1-10. For the purpose of retirement we can equate 1 Point to the equivalent of one day of Active Duty service.

Jerry a CSRS-covered employee retired from federal service with 40 years of service on January 1 2022. In this case the savings of extra retired pay in the High-36 option surpasses the accumulated savings from the bonus when the member is 60. It takes into account the highest 36 months of basic military pay received by a service member during any period of continuous active duty including any periods of active duty for training.

Military Retirement Pay Calculator Using Frozen Benefit Rule. The Opt-in Course should be taken prior to using this calculator. PERS Plan 3 has two parts.

Military Time Buy Back Options - CSRS. The aging of the population changing patterns in work and. The High-3 Calculator is used to calculate the monthly retirement pay for active duty and reserve components of military service.

Military Service after 111957. Smith and Cruz however get a 25 raise because COLAs under the REDUX system are equal to CPI.

Military Compensation Separation Pay 2020

Buying Back Military Time The Ultimate Guide Haws Federal Advisors

Military Compensation Pay Retirement E7with20years

Your High Three Estimate In Our Fers Calculator Retirement Benefits Instituteretirement Benefits Institute

Military Retirement And Transition Services

Military Retired Pay Overview Military Com

Your High Three Estimate In Our Fers Calculator Retirement Benefits Instituteretirement Benefits Institute

Military Compensation Pay Retirement E7with20years

Military Retirement Pay Calculator Military Onesource

Tsp Calculator Shop 53 Off Www Wtashows Com

The Blended Retirement System Explained Military Com

Fers Calculator High 3 For 2022 Youtube

Military Compensation Pay Retirement W3with22years

Csrs Retirement And Pension Calculation Youtube

What Adds Up To A High 3

Military Compensation Pay Retirement W3with22years

Blended Military Retirement System To Take Effect Jan 1 Air Force S Personnel Center Article Display